What is A Medicare Supplement?

A Medicare Supplement policy, often called Medigap, is designed to cover the out-of-pocket costs that Original Medicare doesn’t pay—such as deductibles, copayments, and coinsurance. While Medicare Parts A and B provide essential coverage, many people prefer the added protection and peace of mind that comes from a Supplement. These plans help make your healthcare costs more predictable and eliminate the worry of unexpected medical bills.

One of the biggest benefits of a Medicare Supplement is the freedom it gives you. There are no provider networks, which means you can see any doctor or specialist in the United States who accepts Medicare. If you spend time in multiple states, travel frequently, or simply value flexibility, this level of access is often one of the strongest advantages of Medigap.

These plans are standardized, meaning a Plan G or Plan N offers the same core benefits regardless of the company you choose—what differs is price, rate stability, and customer service.

What A Medicare Supplement Helps Cover

Part A Deductible

Hospital Co-insurance

Medical Co-Insurance

Part B excess Charges

Skilled nursing

Emergency Care overseas

Who Is A Medicare Supplement Best For?

Medigap may be a good fit for you if you want:

The broadest access to doctors nationwide

Predictable out-of-pocket costs

No referrals or network restrictions

To travel around in between states often

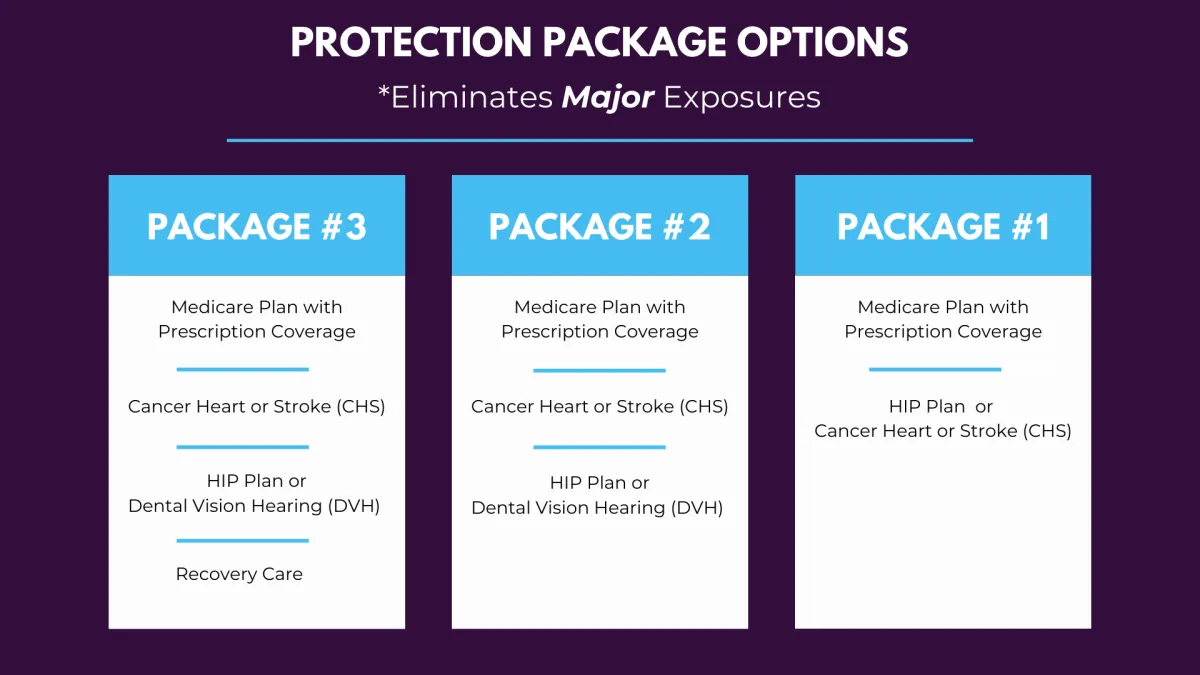

Your Supplement May Not Be Enough

Medicare Supplements still have some exposures. Let us make this easy. Book your appointment today and get a personalized package recommendation tailored to your specific needs and plan to eliminate those gaps in your plan.

Types of Medigap Plans (Simplified)

Plan G

All you pay is the monthly premium and the Medicare Part B deductible

Plan N

You pay the monthly premium

You pay the Medicare Part B deductible

You pay $20 copay for doctor's office visit

You pay $50 copay for emergency room visits

Important Things to Know

Medigap plans do not include prescription drug coverage, so most people pair them with a Part D drug plan.

You must have Medicare Part A and Part B to enroll.

Medigap does not work with Medicare Advantage; you choose one path or the other.

Rates vary by company, age, and location—even though the benefits are standardized.

Why Choosing the Right Supplement Matters

The Medicare Supplement you choose affects how much you’ll pay for healthcare now and in the future. Your premium, your flexibility with doctors, and your long-term rate stability all depend on selecting the right plan from the right company. Even if two plans look identical on paper, factors like rate increases, underwriting, household discounts, and company reputation can make a meaningful difference.

Your health needs, travel habits, and budget are unique—which is why choosing the right Supplement is not simply about picking the lowest price, but choosing a plan that will serve you well over time.

How We Can Help You Navigate This With Confidence

As Independent Brokers we have certain tools that let us:

Compare multiple carriers

See the historic rate increases of each carrier

Explain your options in plain language

Help you find a plan that fits your lifestyle

You Don't Have to Figure This Out Alone

Medicare Supplements comes with a lot of moving parts — like drug coverage, costs, benefits, and deadlines. Let us make this easy. Book your appointment today and get clear, personalized guidance so you can choose the right coverage with confidence.

Medicare Information

COMPANY

LEGAL

SOCIALS

As a national Medicare brokerage, we work with multiple carriers to provide comprehensive plan options. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This is not a complete listing of plans available in your service area. For a complete listing please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov.

Copyright 2026. Guardian Insurance Group LLC. All Rights Reserved.