Why Do I Need Something Else?

Regardless of if you choose a Medicare Supplement or a Medicare Advantage plan, each leaves you with certain out-of-pocket risks and exposures. These add-on plans are designed to protect you financially from the most common and most expensive gaps.

Hospital Indemnity Plan

Medicare Advantage plans typically charge daily copays for hospital stays, ER visits, ambulance rides, observation stays, and sometimes outpatient surgeries. A single hospital stay can easily cost hundreds to thousands of dollars out of pocket. A HIP pays you cash — usually per day in the hospital and for certain other services. That money can be used to cover those copays so your hospital stay does not become a financial burden. It essentially plugs the biggest hole in most Medicare Advantage plans.

Cancer Plan

Cancer treatment is one of the highest out-of-pocket expenses for Medicare beneficiaries. Even with Medicare or Medicare Advantage, you still face 20% coinsurance, expensive oral chemo, travel costs, second opinions, scans, lost income, and more. A diagnosis can create massive unexpected expenses. A Cancer Plan pays a lump-sum cash benefit directly to you upon diagnosis. You can use the money for anything: medical bills, medications, travel, time off work, or household expenses. It gives you immediate financial support during one of life’s hardest moments.

Skilled Nursing Facility (SNF) Plan

After a hospital stay, if you need rehab or skilled nursing care, Medicare covers the first 20 days — after that, if you have a Medicare Advantage plan, you pay a high daily copay (often over $200 per day). Even if you have a Medicare Supplement, Medicare will only cover 100 days of skilled nursing; anything after day 100 falls on you. A lengthy recovery can cost thousands of dollars out of pocket. A Skilled Nursing plan pays daily cash benefits for each day you’re in a facility after your Medicare-covered period ends. This money can offset or fully cover those large daily copays, protecting your savings during long recoveries.

You Don't Have to Figure This Out Alone

Don’t pay more than you need to for life's surprises. Schedule your appointment today and receive a personalized review to put together a perfect package for you and your needs.

Dental, Vision & Hearing Plan

Medicare Supplements do not cover routine dental work, eyeglasses, eye exams, or hearing aids. These services can easily cost thousands of dollars depending on the work you get done. A DVH plan helps pay for cleanings, fillings, crowns, dentures, glasses, contacts, eye exams, hearing exams, and hearing aids. It reduces or eliminates these large unexpected bills and helps you maintain quality of life

Why Choosing the Right Add-Ons Matter

Ancillary coverage isn’t “extra” — it’s what protects you from the financial gaps Medicare leaves behind. Hospital copays, cancer treatment costs, skilled nursing coinsurance, and dental or hearing expenses can all add up quickly. And because every person’s health needs, risks, and lifestyle are different, the right add-on coverage can make the difference between a manageable bill and a major financial setback. These plans are designed to strengthen your Medicare coverage and protect you from the costs most likely to catch people off guard. The right combination of add-ons can give you peace of mind, more predictable expenses, and the confidence that your health and finances are protected — no matter what comes your way.

How We Can Help You Navigate This With Confidence

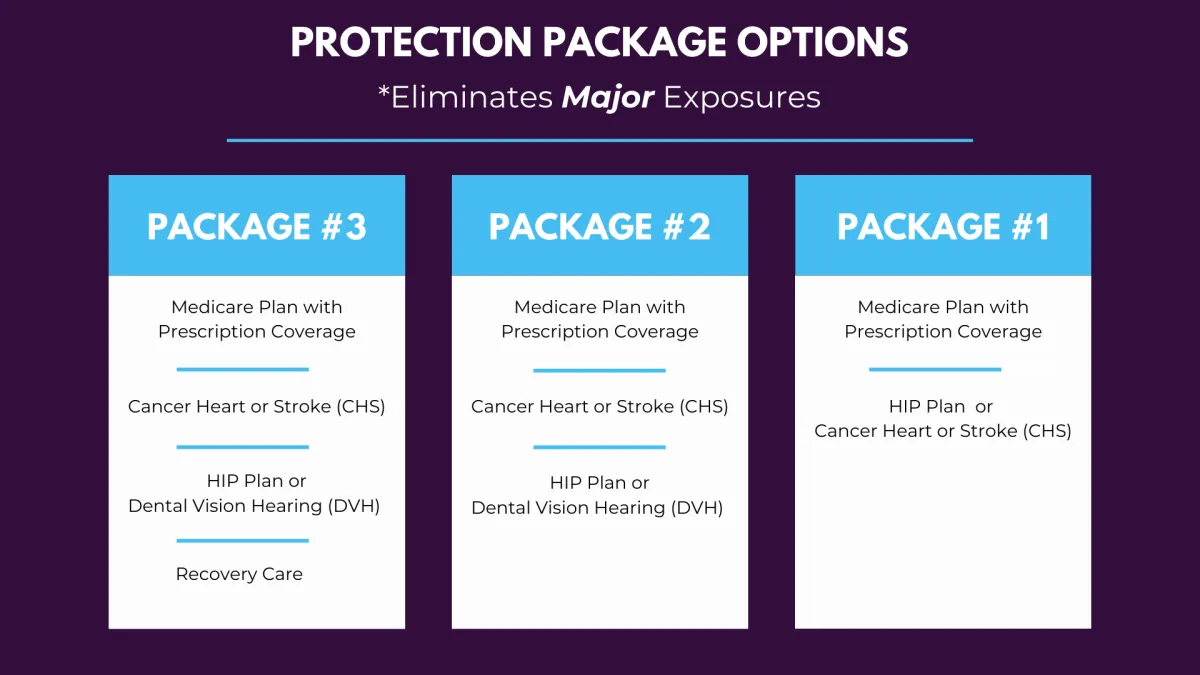

We don’t believe in throwing random add-ons at you or pushing products you don’t need. Instead, we use a personalized packaging system that starts with a simple, conversation-driven discovery meeting. During this meeting, we take time to understand your health history, current needs, medications, budget, lifestyle, goals, and concerns. From there, we use our Package Sheet to help you visualize your coverage gaps and the add-ons that can protect you. We walk through:

Where your Medicare plan leaves exposure

Which risks apply to you specifically

What protection options match your health and financial goals

How to create a balanced, affordable package that actually fits your life

By the end of the process, you’ll know exactly why each plan is being recommended and how it strengthens your overall coverage — with no confusion and no guesswork.

You Don't Have to Figure This Out Alone

Don’t pay more than you need to for life's surprises. Schedule your appointment today and receive a personalized review to put together a perfect package for you and your needs.

Medicare Information

COMPANY

LEGAL

SOCIALS

As a national Medicare brokerage, we work with multiple carriers to provide comprehensive plan options. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This is not a complete listing of plans available in your service area. For a complete listing please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov.

Copyright 2026. Guardian Insurance Group LLC. All Rights Reserved.