What is Medicare Advantage?

A Medicare Advantage Plan is an all-in-one alternative to Original Medicare, offered by private insurance companies approved by Medicare. These plans combine your hospital (Part A), medical (Part B), and often drug coverage (Part D) under one simplified plan — with extra benefits that Original Medicare doesn’t include.

Most Medicare Advantage Plans Include:

Dental, Vision, Hearing

Otc allowance

gym membership

No to low premiums

low copays

max out of pocket limits

Who Is Medicare Advantage Best For?

Medicare Advantage may be a good fit for you if you want:

One plan that handles most of your healthcare

Extras like dental, vision, hearing, or drug coverage

Lower monthly premiums (sometimes even $0)

Predictable copays for doctor visits, hospital stays, and testing

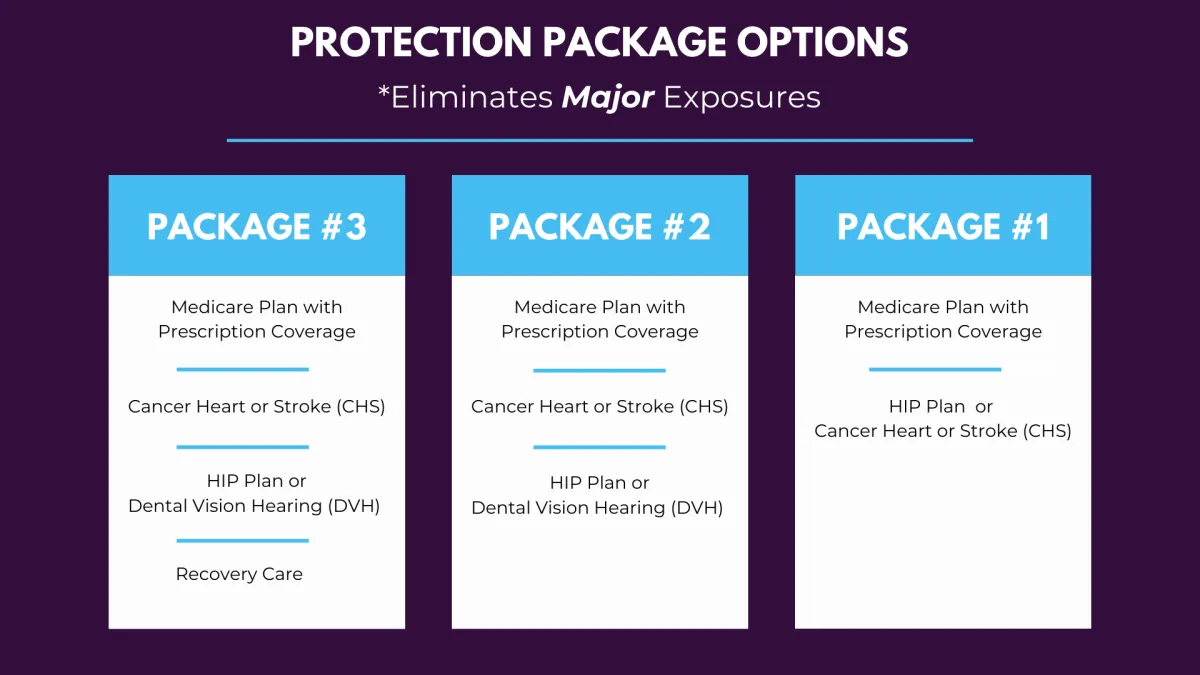

Your Advantage Plan May Not Be Enough

Medicare Advantage comes with some major exposures. Let us make this easy. Book your appointment today and get a personalized package recommendation tailored to your specific needs and plan to eliminate those gaps in your plan.

Types of Medicare Advantage Plans

HMO (Health Maintenance Organization)

Requires using in-network doctors

Referrals often required for specialists

Typically has the lower costs

Great for people whose doctors already participate in the network

PPO (Preferred Provider Organization)

More freedom to see out-of-network providers for a higher copay

Usually no referrals needed

Higher flexibility with slightly higher costs

Perfect for travelers or people with multiple specialists

MA-Only Plans

No built-in drug coverage

Ideal for people who already have credible drug coverage elsewhere (VA, employer, etc.)

Same medical benefits as normal MA plans, minus the Part D component

DSNP (Dual Special Needs Plans)

For people who have both Medicare and Medicaid

Usually offers extra financial help and additional benefits

Lower out-of-pocket costs

Often includes transportation, OTC credits, and more care support

CSNP (Chronic Special Needs Plans)

Designed for specific chronic conditions (e.g., diabetes, CHF, COPD)

Tailored networks, formularies, and care coordination

Helps manage ongoing conditions more effectively than standard plans

Why Choosing the Right Plan Matters

Choosing the right Medicare Advantage plan is important because it impacts nearly every part of your healthcare experience. The plan you enroll in determines which doctors and specialists you can see, how much you pay for services, what your prescription drugs will cost, and what extra benefits you have access to throughout the year. Even if a plan works well for a friend or spouse, that doesn’t automatically mean it’s the best fit for you. Your doctors, medications, and health needs are unique—and your coverage should reflect that.

How We Can Help You Navigate This With Confidence

As Independent Brokers we have certain tools that let us:

Check to see if your doctors are in network

Check to see what plans cover your medications

Check to see what plan meets your needs and budget

Check to see if you qualify for extra benefits or subsidies

You Don't Have to Figure This Out Alone

Medicare Advantage comes with a lot of moving parts — like drug coverage, costs, benefits, networks, deadlines. Let us make this easy. Book your appointment today and get clear, personalized guidance so you can choose the right coverage with confidence.

Medicare Information

COMPANY

LEGAL

SOCIALS

As a national Medicare brokerage, we work with multiple carriers to provide comprehensive plan options. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. This is not a complete listing of plans available in your service area. For a complete listing please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov.

Copyright 2026. Guardian Insurance Group LLC. All Rights Reserved.